Kidder Peabody on:

[Wikipedia]

[Google]

[Amazon]

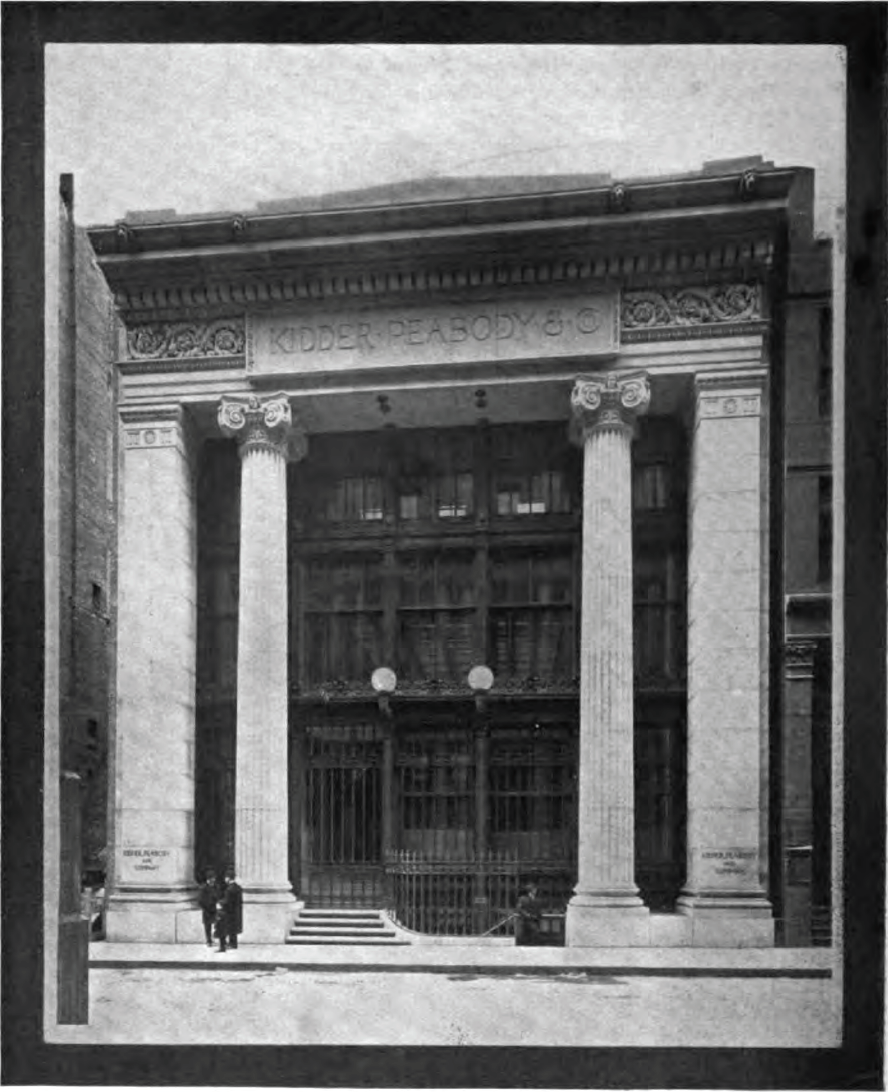

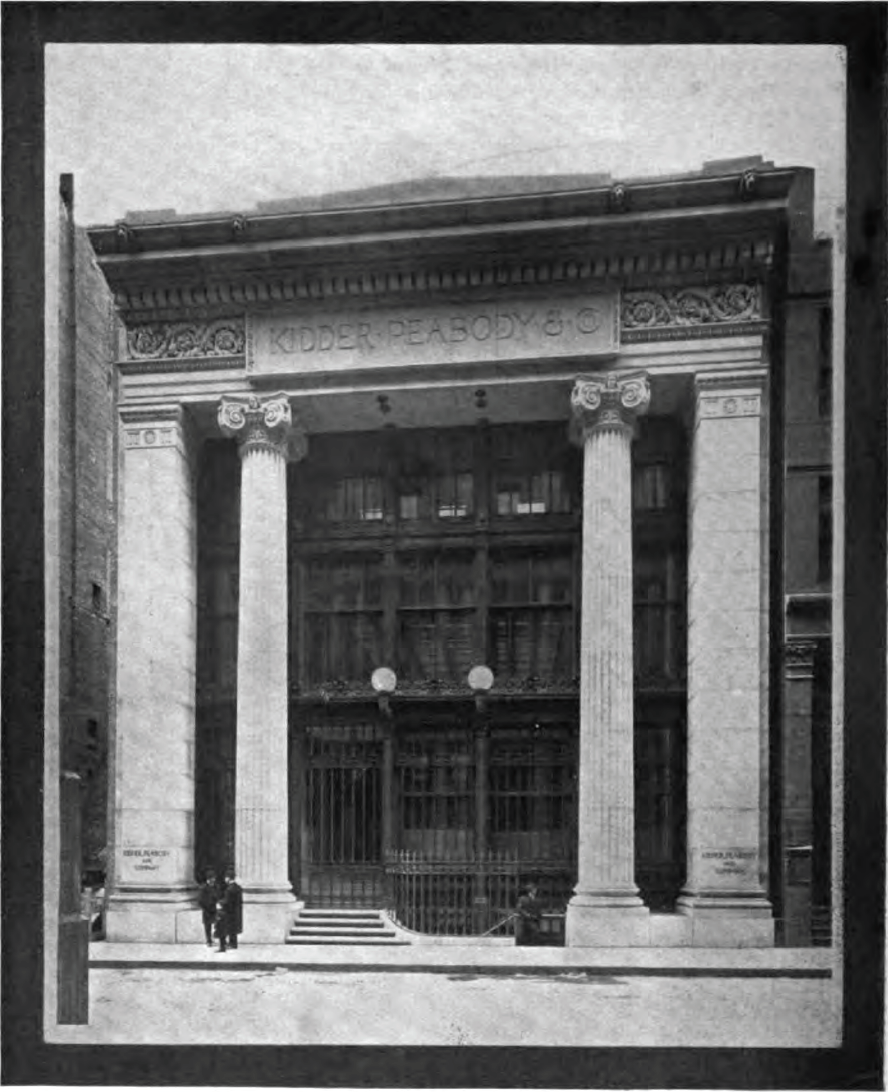

Kidder, Peabody & Co. was an American securities firm, established in

Kidder, Peabody & Co. was established in April 1865 by Henry P. Kidder, Francis H. Peabody, and Oliver W. Peabody. The firm was formed via reorganization of its predecessor company, J.E. Thayer & Brother, where the three founders had previously worked as clerks.

Kidder, Peabody & Co. was established in April 1865 by Henry P. Kidder, Francis H. Peabody, and Oliver W. Peabody. The firm was formed via reorganization of its predecessor company, J.E. Thayer & Brother, where the three founders had previously worked as clerks.

Kidder Peabody acted as a

Kidder Peabody acted as a

In 1967, Kidder Peabody helped to arrange a deal whereby the USDA's Commodity Credit Corporation invested $21.8 million in the failing Lebanese

In 1967, Kidder Peabody helped to arrange a deal whereby the USDA's Commodity Credit Corporation invested $21.8 million in the failing Lebanese

U.S. Securities and Exchange Commission, March 5, 2004 Jett's implosion forced GE to take a $210 million charge to its first-quarter earnings ($350 million before taxes). Years later, Welch recalled that GE business leaders were so shaken by the huge loss that they offered to dip into the coffers of their own divisions to close the gap. In contrast, Welch said, no one at Kidder was willing to take responsibility for the debacle.

New York Times, June 5, 1994 Although Kidder had rebuilt itself with mortgage-backed bonds, negative media coverage following the disclosure of Jett's overstated profits led GE to sell most of Kidder Peabody's assets to PaineWebber for $670 million, in October 1994. The transaction closed in January 1995, and the Kidder Peabody name was retired. Years later, Welch claimed that the Jett debacle was a reminder that Kidder had been "a headache and an embarrassment from the start" for GE. Earlier, several GE board members with experience in financial services, such as

Now It's Joseph Jett's Turn

"Wall Street Lynching"- Joseph Jett interview.

Time Magazine, Mar. 30, 1931

TheStreet.com

Time magazine, Feb. 23, 1987

Kidder, Peabody & Company Records

at Baker Library Special Collections, Harvard Business School {{DEFAULTSORT:Kidder, Peabody and Co. UBS Defunct financial services companies of the United States Financial services companies established in 1865 Financial services companies disestablished in 1994 Former investment banks of the United States

Massachusetts

Massachusetts (Massachusett: ''Muhsachuweesut Massachusett_writing_systems.html" ;"title="nowiki/> məhswatʃəwiːsət.html" ;"title="Massachusett writing systems">məhswatʃəwiːsət">Massachusett writing systems">məhswatʃəwiːsət'' En ...

in 1865. The firm's operations included investment banking, brokerage, and trading.

The firm was sold to General Electric

General Electric Company (GE) is an American multinational conglomerate founded in 1892, and incorporated in New York state and headquartered in Boston. The company operated in sectors including healthcare, aviation, power, renewable en ...

in 1986. Following heavy losses, it was subsequently sold to PaineWebber in 1994. After the acquisition by PaineWebber, the Kidder Peabody name was dropped, ending the firm's 130-year presence on Wall Street. Most of what was once Kidder Peabody is now part of UBS AG

UBS Group AG is a multinational investment bank and financial services company founded and based in Switzerland. Co-headquartered in the cities of Zürich and Basel, it maintains a presence in all major financial centres as the largest Swis ...

, which acquired PaineWebber in November 2000.

History

Early history

Kidder, Peabody & Co. was established in April 1865 by Henry P. Kidder, Francis H. Peabody, and Oliver W. Peabody. The firm was formed via reorganization of its predecessor company, J.E. Thayer & Brother, where the three founders had previously worked as clerks.

Kidder, Peabody & Co. was established in April 1865 by Henry P. Kidder, Francis H. Peabody, and Oliver W. Peabody. The firm was formed via reorganization of its predecessor company, J.E. Thayer & Brother, where the three founders had previously worked as clerks.

Kidder Peabody acted as a

Kidder Peabody acted as a commercial bank

A commercial bank is a financial institution which accepts deposits from the public and gives loans for the purposes of consumption and investment to make profit.

It can also refer to a bank, or a division of a large bank, which deals with cor ...

, investment bank

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort.

In finance, the purpose of investing is ...

, and merchant bank

A merchant bank is historically a bank dealing in commercial loans and investment. In modern British usage it is the same as an investment bank. Merchant banks were the first modern banks and evolved from medieval merchants who traded in commodi ...

. The firm had an active securities business, dealing in treasury bonds

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. gov ...

and municipal bonds

A municipal bond, commonly known as a muni, is a bond issued by state or local governments, or entities they create such as authorities and special districts. In the United States, interest income received by holders of municipal bonds is often, ...

, as well as corporate bond

A corporate bond is a bond issued by a corporation in order to raise financing for a variety of reasons such as to ongoing operations, M&A, or to expand business. The term is usually applied to longer-term debt instruments, with maturity of ...

s and stock

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company ...

s. Kidder Peabody also actively traded and invested in securities for its own account.

In the aftermath of the 1929 stock market crash, Kidder Peabody was in a perilous situation. In 1931, Albert H. Gordon bought the struggling firm with financial backing from Stone & Webster. Since electric utilities were considered somewhat risky, Stone & Webster set up its own investment banking operation to finance their own projects through bond sales. Many of the utilities were municipally owned and Stone & Webster's investment banking unit served them in other offerings. Eventually, as fewer investment banking clients were engineering clients, there was an incentive to divest and merge the unit with another investment bank. Edwin Webster's father, Frank G. Webster, was a senior partner of Kidder Peabody, and Kidder had actively supported Charles A. Stone and Edwin as they started The Massachusetts Electrical Engineering Company, which later became Stone & Webster, in the 1890s. Gordon helped rebuild Kidder Peabody by focusing on specific niche markets including utility finance and municipal bonds. Stone & Webster had thus become an integrated company which designed utility projects, built them, financed them, and operated them for municipalities.

In 1967, Kidder Peabody helped to arrange a deal whereby the USDA's Commodity Credit Corporation invested $21.8 million in the failing Lebanese

In 1967, Kidder Peabody helped to arrange a deal whereby the USDA's Commodity Credit Corporation invested $21.8 million in the failing Lebanese Intra Bank

Intra Bank (also known as Banque Intra or بنك انترا) was a Lebanese bank, and the largest financial institution in Lebanon until its collapse in 1966.

Foundation and rise of the bank

The bank was founded in 1951 by Yousef Beidas and th ...

, a cornerstone of the Lebanese banking industry. This move likely contributed to preventing a major financial crisis in Lebanon from worsening.

In the 1970s – R&D and finance

Kidder Peabody was among the first Wall Street firms to start and dedicate an entire department to financialresearch and development

Research and development (R&D or R+D), known in Europe as research and technological development (RTD), is the set of innovative activities undertaken by corporations or governments in developing new services or products, and improving existi ...

. In the Late 1970s, it hired Yale

Yale University is a private research university in New Haven, Connecticut. Established in 1701 as the Collegiate School, it is the third-oldest institution of higher education in the United States and among the most prestigious in the wor ...

Professor John Geanakoplos

John Geanakoplos (born March 18, 1955) is an American economist, and the current James Tobin Professor of Economics at Yale University.

Background and education

John Geanakoplos was born to a Greek-American family of scholars. His father was th ...

to start an R&D department to research and analyse the connection between finance and mathematics. Gradually the department grew to contain 75 prominent academics, and continued to function till Kidder Peabody's closure.

Kidder and the 1980s insider trading scandal

Gordon served as Kidder's chairman until selling it to General Electric in 1986. GE believed that Kidder would be a good fit for its financial services division,GE Capital

GE Capital is the financial services division of General Electric.

The company currently only runs one division, GE Energy Financial Services. It had provided additional services in the past; however, those units were sold between 2013 and 2018 ...

. GE executives had felt chagrin at putting up money to finance leveraged buyout

A leveraged buyout (LBO) is one company's acquisition of another company using a significant amount of borrowed money (leverage) to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loan ...

s, only to have to pay large fees to other investment banks. GE believed that it made sense to find a way to keep these fees for itself after taking such expensive risks. Thus, when Gordon concluded that Kidder could not stay independent, he found a receptive ear in GE chairman Jack Welch

John Francis Welch Jr. (November 19, 1935 – March 1, 2020) was an American business executive, chemical engineer, and writer. He was Chairman and CEO of General Electric (GE) between 1981 and 2001.

When Welch retired from GE, he receive ...

. GE initially left the firm in the hands of Gordon's longtime heir apparent, Ralph DeNunzio.'' Den of Thieves''. Stewart, J. B. New York: Simon & Schuster, 1991. .''Jack: Straight From The Gut'', by Jack Welch - Warner Business Books (2001)()

Soon after the GE purchase, a skein of insider trading scandals, which came to define the Street of the 1980s and were depicted in the James B. Stewart

James Bennett Stewart (born c. 1952) is an American lawyer, journalist, and author.

Early life and education

Stewart was born in Quincy, Illinois. He graduated from DePauw University and Harvard Law School.

Career

He is a member of the Bar o ...

bestseller '' Den of Thieves'', swept Wall Street. The firm was implicated when former Kidder Peabody executive and merger specialist Martin Siegel—who had since become head of mergers and acquisitions at Drexel Burnham Lambert

Drexel Burnham Lambert was an American multinational investment bank that was forced into bankruptcy in 1990 due to its involvement in illegal activities in the junk bond market, driven by senior executive Michael Milken. At its height, it was a ...

—admitted to trading on inside information with super-arbitrageurs Ivan Boesky

Ivan Frederick Boesky (born March 6, 1937) is a former American stock trader who became infamous for his prominent role in an insider trading scandal that occurred in the United States during the mid-1980s. He was charged and pled guilty to insi ...

and Robert Freeman. Siegel also implicated Richard Wigton, Kidder's chief arbitrageur. Wigton was the only executive handcuffed in his office as part of the trading scandal, an act that was later depicted in the movie ''Wall Street

Wall Street is an eight-block-long street in the Financial District of Lower Manhattan in New York City. It runs between Broadway in the west to South Street and the East River in the east. The term "Wall Street" has become a metonym for t ...

''.

With Rudy Giuliani

Rudolph William Louis Giuliani (, ; born May 28, 1944) is an American politician and lawyer who served as the 107th Mayor of New York City from 1994 to 2001. He previously served as the United States Associate Attorney General from 1981 to 198 ...

, then the United States Attorney for the Southern District of New York

The United States Attorney for the Southern District of New York is the chief federal law enforcement officer in eight New York counties: New York (Manhattan), Bronx, Westchester, Putnam, Rockland, Orange, Dutchess and Sullivan. Establishe ...

, threatening to indict the firm, Kidder was initially poised to fight the government. However, GE officials were somewhat less inclined to fight, given that Siegel had admitted wrongdoing. A GE internal review concluded that DeNunzio and other executives had not done enough to prevent the improper sharing of information. and also revealed glaring weaknesses in the firm's internal controls. Notably, Siegel was able to move about the trading floor as he pleased, and Wigton and Tabor did Siegel-requested trades with almost no questions asked. In response, GE fired DeNunzio and two other senior executives, stopped trading for its own account, and agreed to a $25.3 million settlement with the SEC.

Years later, in his autobiography, ''Jack: Straight from the Gut,'' Welch said that the aftermath of the insider trading scandal led him to conclude that buying Kidder had been a mistake. He was appalled by the firm's outsize bonus pool, which was $40 million greater than the GE corporate pool at the time even though Kidder accounted for only 0.05 percent of GE's income. He also didn't understand how "mediocre people" were garnering such high bonuses. Soon after Black Monday

Black Monday refers to specific Mondays when undesirable or turbulent events have occurred. It has been used to designate massacres, military battles, and stock market crashes.

Historic events

*1209, Dublin – when a group of 500 recently arriv ...

, Welch and other GE executives resolved to sell off Kidder at the first opportunity that they could do so "without losing our shirt."

1994 bond trading scandal

Kidder Peabody was later involved in a trading scandal related to false profits booked from 1990 to 1994. Joseph Jett, a trader on the government bond desk, was found to have systematically exploited a flaw in Kidder's computer systems, generating large false profits. When the fraud was discovered, it was determined that Jett's claimed profits of $275 million over four years had actually been a $75 million loss. The NYSE barred Jett from securities trading or working for any firm affiliated with the exchange, a move that effectively banned him from the securities industry. The SEC subsequently formalized his ban from the industry, and ultimately concluded that Jett's actions amounted to securities fraud.In the Matter of Orlando Joseph JettU.S. Securities and Exchange Commission, March 5, 2004 Jett's implosion forced GE to take a $210 million charge to its first-quarter earnings ($350 million before taxes). Years later, Welch recalled that GE business leaders were so shaken by the huge loss that they offered to dip into the coffers of their own divisions to close the gap. In contrast, Welch said, no one at Kidder was willing to take responsibility for the debacle.

New York Times, June 5, 1994 Although Kidder had rebuilt itself with mortgage-backed bonds, negative media coverage following the disclosure of Jett's overstated profits led GE to sell most of Kidder Peabody's assets to PaineWebber for $670 million, in October 1994. The transaction closed in January 1995, and the Kidder Peabody name was retired. Years later, Welch claimed that the Jett debacle was a reminder that Kidder had been "a headache and an embarrassment from the start" for GE. Earlier, several GE board members with experience in financial services, such as

Walter Wriston

Walter Bigelow Wriston (August 3, 1919 – January 19, 2005) was a banker and former chairman and CEO of Citicorp. As chief executive of Citibank / Citicorp (later Citigroup) from 1967 to 1984, Wriston was widely regarded as the single most inf ...

of Citicorp

Citigroup Inc. or Citi (stylized as citi) is an American multinational investment bank and financial services corporation headquartered in New York City. The company was formed by the merger of banking giant Citicorp and financial conglomer ...

and Lewis Preston of J.P. Morgan, had warned him that a securities firm was very different from other GE businesses; as Wriston put it, "all you're buying is the furniture." The experience led Welch to pass on numerous other acquisition opportunities for GE that made strategic sense on paper after he concluded that they didn't fit with GE's culture.

September 11, 2001 terrorist attacks

On September 11, the former offices of Kidder Peabody (which were occupied by PaineWebber, as they had assumed the lease as part of the acquisition in 1994) were among many businesses impacted by theterrorist attacks

The following is a list of terrorist incidents that have not been carried out by a state or its forces (see state terrorism and state-sponsored terrorism). Assassinations are listed at List of assassinated people.

Definitions of terrori ...

. The company had offices on the 101st Floor of One World Trade Center

One World Trade Center (also known as One World Trade, One WTC, and formerly Freedom Tower) is the main building of the rebuilt World Trade Center complex in Lower Manhattan, New York City. Designed by David Childs of Skidmore, Owings & Mer ...

, also known as the North Tower. Two PaineWebber employees lost their lives.

Associated people

* Prince Abbas Hilmi, Vice President of Kidder, Peabody & Co. / Executive Director of Kidder, Peabody International Investments (1986–1989) * Lloyd B. Waring, Vice President of Kidder, Peabody & Co. *Lana Del Rey

Elizabeth Woolridge Grant (born June 21, 1985), known professionally as Lana Del Rey, is an American singer-songwriter. Her music is noted for its cinematic quality and exploration of tragic romance, glamour, and melancholia, with frequent ...

's paternal grandfather, Robert England Grant Sr. (Brown

Brown is a color. It can be considered a composite color, but it is mainly a darker shade of orange. In the CMYK color model used in printing or painting, brown is usually made by combining the colors orange and black. In the RGB color model used ...

'48, Harvard MBA '50) was a Kidder, Peabody & Co. investment banker, later vice president at Plough, Inc and Textron

Textron Inc. is an American industrial conglomerate based in Providence, Rhode Island. Textron's subsidiaries include Arctic Cat, Bell Textron, Textron Aviation (which itself includes the Beechcraft, and Cessna brands), and Lycoming Engines. ...

, and venture capitalist.

*Christian Gerhartsreiter

Christian Karl Gerhartsreiter (born February 21, 1961) is a German convicted murderer and impostor. Born in West Germany, he is currently serving a prison sentence in the U.S. state of California. After moving to the U.S. in his late teens, Gerh ...

, serial impostor, was briefly employed at Kidder, Peabody & Co. under the alias "Christopher C. Crowe" in the late 1980s.''The Man in the Rockefeller Suit''; '' Vanity Fair'', January 2009.

*Roger Tamraz Roger Edward Tamraz (Arabic: روجيه تمرز) is an international banker and venture capital investor who has had an active business career in oil and gas in the Middle East, Europe, Asia and the United States since the early 1960s. He is the bi ...

See also

*General Electric

General Electric Company (GE) is an American multinational conglomerate founded in 1892, and incorporated in New York state and headquartered in Boston. The company operated in sectors including healthcare, aviation, power, renewable en ...

*Paine Webber

PaineWebber & Co. was an American investment bank and stock brokerage firm that was acquired by the Swiss bank UBS in 2000. The company was founded in 1880 in Boston, Massachusetts, by William Alfred Paine and Wallace G. Webber. Operating with t ...

* Martin A. Siegel

* Joseph Jett

References

Now It's Joseph Jett's Turn

"Wall Street Lynching"- Joseph Jett interview.

Time Magazine, Mar. 30, 1931

TheStreet.com

Time magazine, Feb. 23, 1987

External links

Kidder, Peabody & Company Records

at Baker Library Special Collections, Harvard Business School {{DEFAULTSORT:Kidder, Peabody and Co. UBS Defunct financial services companies of the United States Financial services companies established in 1865 Financial services companies disestablished in 1994 Former investment banks of the United States